Wed 17 Sep: After the Bell

🎙️📄+ Market Data

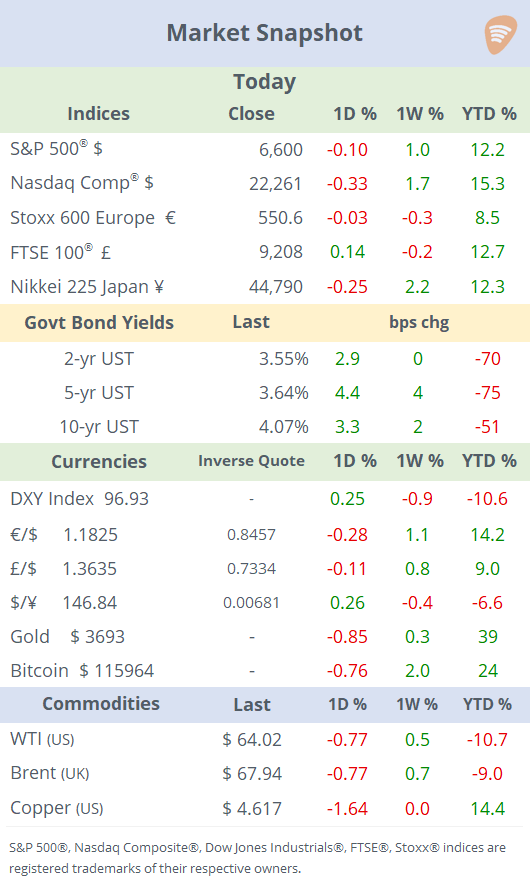

See the ‘Market Data’ post.

Good evening,

Markets were volatile today as stocks, bonds, and the dollar reacted to the Fed’s rate cut and Powell’s press conference, with market sentiment cautiously optimistic. Nasdaq indices fell more than 1% at one point before sharply reversing to finish marginally lower. The small-cap Russell 2000 staged a strong rally before giving up most of its gain. The VIX spiked to 16.7% before easing to 15.6%, 10-year Treasury yields swung 11bp intraday to close just 3bp higher at 4.07%, and the dollar index traded at its lowest level in 3.5 years before recovering to end a touch firmer.

Monetary Policy: As widely anticipated, the Fed lowered rates by a quarter point to a 4.00–4.25% range, the lowest in nearly three years and its first cut in nine months, with officials signalling more easing ahead. Eleven of 12 policymakers backed the move, while newly appointed Governor Miran argued for a deeper half-point cut (see Market Data for chart).

Chair Jerome Powell highlighted “moderation in growth,” a weak housing sector, and payroll gains slowing sharply to an average of just 29k per month over the past three months. The Fed cited a softening job market as outweighing recent inflation upticks, and a narrow majority of officials projected at least two further cuts this year, likely at the October and December meetings. The Fed’s "dot plot" reveals significant divergence among policymakers regarding future interest rates, with Miran as the most dovish member.

“The labour market is softening, and we don’t need it to soften anymore (and) don’t want it to,” Powell said. “There wasn’t widespread support at all for a 50bp,” he added.

The Bank of Canada also cut its policy rate by 25bp to 2.50% as expected, its first reduction in six months, citing a weakening job market, reduced inflationary pressures, and the removal of many retaliatory tariffs. It signalled it’s ready to ease further “one meeting at a time” if risks rise, especially watching how exports, business investment and inflation trends evolve. Core inflation remains near the top of its 1-3% target but appears to be easing. The yield on three-year Canadian bonds has been shifting downwards in the past four weeks to 2.53%.

"Considerable uncertainty remains. But with a weaker economy and less upside risk to inflation, the Governing Council judged that a reduction in the policy rate was appropriate to better balance the risks going forward," the BoC Governor said.

Business headlines: China has banned tech companies from buying Nvidia’s AI chips as Beijing intensifies efforts to boost semiconductor independence and compete with the U.S. Nvidia fell over 2%.

Data: UK headline consumer inflation was unchanged at 3.8% YoY in August, the highest since January 2024, while core inflation eased to 3.6%; today’s release was the final reading. Eurozone headline inflation was 2.0% YoY in August (unch from July), while core inflation (excluding energy & food) held at 2.3%. U.S. housing starts fell 8.5% in August to a seasonally adjusted annual rate of 1.307mn units, with single-family starts down 7.0% to 890k, the weakest single-family pace since April 2023.

Corporate Deals: Abu Dhabi’s Adnoc has abandoned its $18.7bn bid for Australian group Santos Ltd (mcap $16.7bn) after the state oil company’s proposed offer for the LNG business ran into political and commercial hurdles.

Alternative asset manager Rithm Capital (mcap $6.6bn) will acquire Paramount Group (mcap $1.56bn), a real estate investment trust, for $1.6bn in cash. Paramount shares fell 11% today but remain 32% higher YTD.

IPOs: Entertainment ticket-resale platform StubHub Holdings (STUB) was priced at $23.50, raised about $800mn on the NYSE for a total valuation of $8.6bn. Stock fell below its IPO price on today’s debut, down ~6%.

Water management and infrastructure firm, WaterBridge Infrastructure (WBI) was priced at $20, raised $634mn on the NYSE, valuing the company at around $2.3bn. Shares rallied 14% on their debut.

Day ahead: BoE policy meeting at noon London time (steady at 4% exp), US weekly jobless claims; FedEx reports results.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.