Wed 19 Nov: After the Bell

Your 5’ evening market wrap 📄📈

See the ‘Market Data’ post for tables & charts.

Good evening,

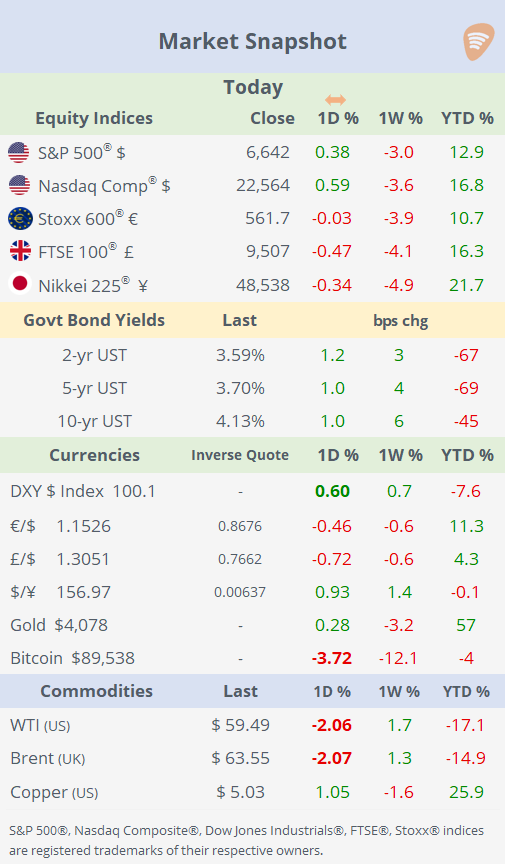

Markets traded cautiously on Wednesday, with investors focused on Nvidia’s earnings after the close. Most major stock indices closed higher during the session after several days of weakness, though only about half of the sectors finished in the green, with energy lagging amid weaker crude prices.

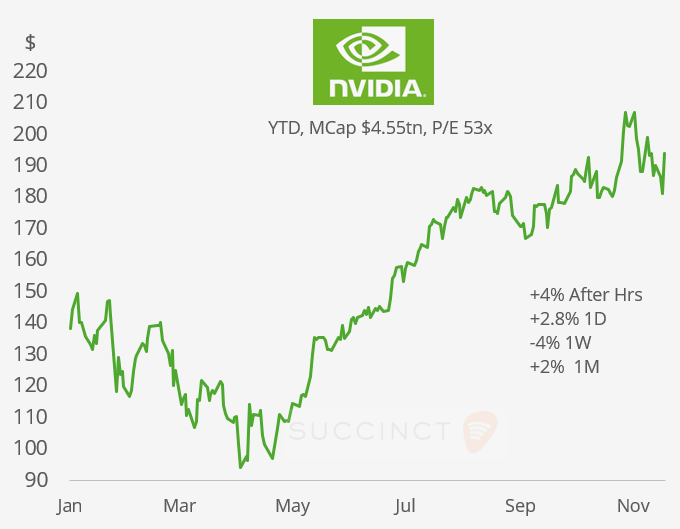

Nvidia beat both top-line ($57bn, +62% YoY) and bottom-line ($1.30 EPS, +60% YoY) estimates for Q3 and gave a Q4 revenue outlook above forecasts, sending its shares up more than 4% in extended trading following a 2.8% gain during the regular session.

Forex markets were active today with a strong appreciation of the $ against most majors, with the DXY index advancing 0.6% to close above 100 points for the first time in two weeks as the ¥, £, and the Swiss franc fell sharply. Core bond yields finished only a touch higher despite the hawkish FOMC Minutes and the re-pricing of December’s Fed meeting.

The crypto selloff intensified with Bitcoin (-3.5%) and Ethereum (-5.5%) accelerating their downward trend as investors remove risk from the asset class. Bitcoin has lost 28% from its early October record high, and it breached the $90,000 level today.

Geopolitics: → Washington and Riyadh struck a wide-ranging strategic deal that includes a major AI cooperation pact, civil nuclear energy partnerships, and the long‑awaited US approval to sell F‑35 stealth jets to Saudi Arabia, underscoring a deepening tech and defence alignment between the two countries.

→ China has suspended all imports of Japanese seafood, escalating tensions following remarks by Japan’s prime minister on Taiwan. The ban, confirmed by China’s foreign ministry, reflects one of the most serious bilateral disputes between the two countries in years.

Earnings: → Lowe’s Companies (mcap $130bn) beat analysts’ estimates with adjusted EPS of $3.06 (+6% YoY) on $20.8bn in revenue, and shares rose 4%. Lowe’s raised its full‑year sales outlook but trimmed its EPS guidance to ~$12.25, citing flat comparable‑sales expectations and macro uncertainty.

Data: → FOMC minutes from October revealed policymakers remain cautious on inflation and divided on the path for December, signalling that a rate cut is far from certain. Markets reacted sharply, with the probability of a Fed rate cut in December falling from 50% yesterday to 32% today.

→ The UK’s headline CPI inflation slowed to 3.6% in the 12 months to October, down from 3.8% in September, while core inflation (excluding food, energy, alcohol and tobacco) eased to 3.4% from 3.5%, reinforcing market bets on a December rate cut by the Bank of England. The decline was driven primarily by a softer rise in gas and electricity prices, as well as falling hotel prices, signalling a broader cooling of price pressures.

With the economy barely growing (0.1% in Q3), unemployment at 5%, and next week’s Budget expected to include significant tax increases, markets judged that monetary easing is now more likely. Cable fell more than 0.5% to 1.3071, and Gilts yields rose ~6bp to 4.613%.

→ The final reading for the €‑area annual inflation rate stood at 2.1% in October, down from 2.2% in September. The data showed services inflation remained elevated (~3.4%) while energy prices dragged down the headline rate, reinforcing the view that the European Central Bank will keep interest rates on hold for now.

→ US oil markets saw mixed signals on Wednesday. The Energy Information Administration (EIA) reported a decline in crude inventories last week, suggesting tightening supply, while industry data from the American Petroleum Institute (API) showed a 4.45mn barrel rise in US crude and fuel stocks over the same period. The contrasting readings have left traders weighing supply pressures against signs of weakening demand in the world’s largest oil consumer, contributing to WTI’s 2.5% drop.

→ US jobs data for November will be released on December 16. The report will include the October payrolls delayed due to the shutdown, but no unemployment rate for that month.

Deals: It was a quiet day on the M&A and IPO front today. → Adobe (mcap $135bn) will acquire Semrush (mcap $1.76bn), a software platform for search-engine optimisation and digital marketing, in an all-cash deal valued at $1.9bn, paying $12/ share. The acquisition expands Adobe’s AI-driven marketing capabilities. Semrush’s shares jumped 75% today and are flat this year.

Day Ahead: → Data: US non-farm payrolls (for Sep, +22k exp), existing home sales, Philly Fed Mfg, initial jobless claims; China LPR rates; Canada and Germany PPI.

→ Earnings: Walmart, Intuit, Ross Stores, Gap and Copart.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.