Wed 22 Oct: After the Bell

🎙️📄+ Market Data.

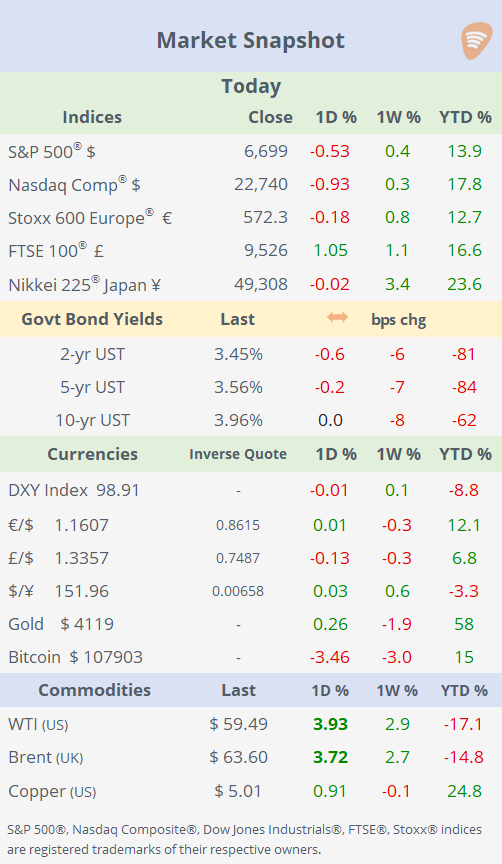

See the ‘Market Data’ post for tables & charts. ➡️

ℹ️ USMD’s subscription costs $7.50 per month with the annual plan – for now, and has a 7-day trial. Visit About to learn about the Refer & Save program and pay even less.

Good evening,

Risk assets fell on Wednesday, led by technology shares, as renewed trade tensions weighed on sentiment. The Nasdaq Composite fell 1%, led by declines in Technology and Industrials, while mid- and small-cap benchmarks underperformed with losses of around 1.5%.

Bonds and major currencies were little changed, with most of the market action concentrated in equities. Crude oil, rallied 4% after EIA data showed a notable decline (-1mn barrels) in US inventories, the first drop in four weeks.

Today’s catalyst for weaker sentiment was the news that Washington is considering broad new export curbs specifically targeting software-powered exports to China, including laptops, jet engines, and other products that are made with US software. This move is a direct response to China’s recent expansion of rare earth export restrictions, critical for global tech manufacturing.

Earnings: Tesla reported after the bell, posting revenues of $28bn (+12% YoY), slightly above estimates, but missing on earnings as adjusted EPS came in at $0.50 versus $0.54 expected. Net income totalled $1.8bn (-29% YoY), while gross margin at 18% topped forecasts amid record vehicle deliveries. The stock ended the session marginally lower and was little changed to slightly weaker in extended trading. (FT)

Pre-market open releases, AT&T, SAP and Barclays, presented mostly positive results with Barclays as the main mover, gaining 5% to the highest level since 2008, thanks to a surprise share buyback and plan to shift to quarterly buyback announcements, signalling confidence in their capital position and future performance.

Data: The only significant release today was UK inflation. Headline CPI held steady at 3.8% in September, below expectations for a modest rise. Core CPI eased slightly to 3.5% from 3.6%, marking the lowest since May and signalling gradual disinflation (see Market Data for chart). Services inflation remained sticky at 4.7%, showing underlying price pressures persist. The data support expectations that the Bank of England will stay cautious and avoid near-term rate cuts despite weak growth indicators. The BoE meets next on Nov 6.

The 10-year Gilt yield fell 5bp to 4.43%, its lowest closing level this year, and the FTSE 100 outperformed all EU and US benchmarks, +1% today, to accumulate a 16.6% YTD return.

Deals: It was a quiet day on the deals front. In private markets, Veeam Software, owned by private equity firm Insight Partners, has agreed to acquire Securiti AI for $1.7bn in cash and stock, marking a significant expansion in enterprise AI data security. (BBG)

Central Banks (EM): Indonesia’s central bank surprised markets by keeping interest rates unchanged at its October meeting, halting its easing cycle after three consecutive cuts to support the rupiah. Bank Indonesia left its benchmark seven-day reverse repo rate steady at 4.75%. (WSJ)

Day Ahead: Economics: Korea’s policy rate, US existing home sales, €-zone consumer confidence. Earnings: T-Mobile, Blackstone, Intel, Ford, Honeywell and Unilever.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.