Wed 24 Sep: After the Bell

🎙️📄+ Market Data

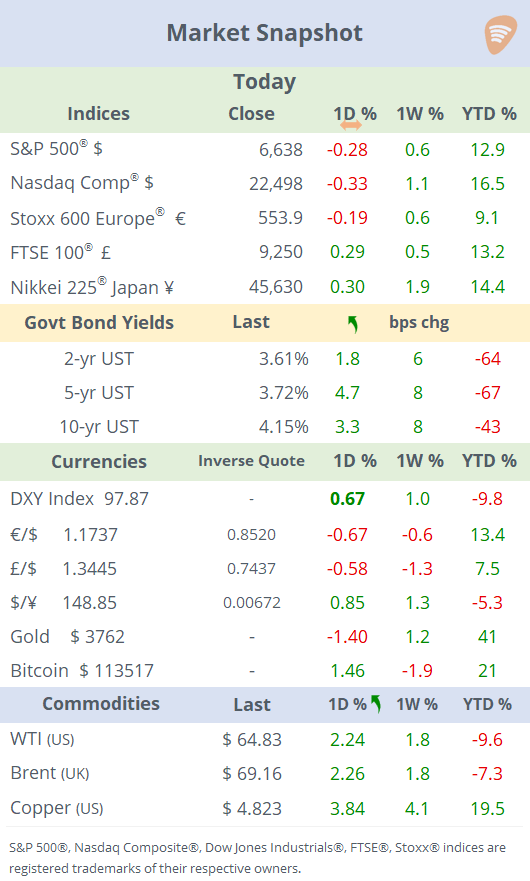

See the ‘Market Data’ post❗

Good evening,

Equity indices fell for a second straight day from their recent all-time highs, with the small-cap Russell 2000 leading the decline. Sector performance was mixed, as energy held up best while materials lagged. Market attention remains fixed on the prospects for interest rate cuts, with comments from Fed officials this week highlighting growing disagreement over the policy path amid signs of weakness in the employment market. Investors now look ahead to Friday’s PCE inflation report for the next major data test.

The $ appreciated today with the DXY Index advancing 0.7% to its highest close in three weeks, driven mainly by a drop in the yen due to a weak PMI reading and a fall in the € on the back of weak German Ifo surveys.

In commodities, U.S. crude inventories fell by 600K barrels, defying expectations for a build, which offered support to oil markets. WTI rose over 2% today on the data and tightening supply signals.

Central Banks: Chicago Fed President Goolsbee warned of a series of rate cuts at the coming meetings, adding that a sharp slowdown in the labour market is not a sign of a recessionary period.

Regarding tariffs, Washington officially implemented the trade deal with the EU that reduces tariffs on autos and auto parts from 25% to 15%, retroactive to August 1, while steel and aluminium tariff discussions remain ongoing.

Data: US new home sales surged 20% MoM in August to an annualised 800,000 units, the strongest pace in three years, signalling resilient housing demand despite higher mortgage rates.

Germany’s Ifo surveys all weakened in September, pointing to a further loss of business confidence as both current conditions and expectations deteriorated.

Deals: In private markets, crypto stablecoin Tether is reportedly seeking to raise $15–20bn in a private funding round, which could value it near $500bn and push it among the most valuable private companies.

Norway’s SWF is investing €4.5bn for a 22% stake in TenneT, Germany’s transmission grid, a key hub for renewable energy distribution.

In special situations, privately held First Brands Group, a U.S. auto parts supplier now in financial distress, is currently preparing for a potential bankruptcy as its debt crumbles and lenders question its financial disclosures.

Canadian miner Lithium Americas (mcap $1.47bn) surged 97% on reports that the U.S. government is considering acquiring up to a ~10% stake tied to the renegotiation of a $2.2bn loan to support its Thacker Pass lithium project in Nevada.

In DCM, Oracle plans to issue $15bn in bonds split across up to seven tranches, to help fund its AI-cloud infrastructure expansion.

Day Ahead: Monetary policy meetings by the Swiss National Bank (unch at 0% exp) and Banxico (-25bp exp); US durable goods, existing home sales and weekly jobless claims; earnings by Costco and Accenture.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.