Wed 26 Nov: After the Bell

Your 5’ evening market wrap 📄📈

ℹ️ Today’s performance tables & charts on the ‘Market Data’ post.

Be 😎 and share USMD will your friends.

ℹ️ We started posting a ‘Morning Markets Update’ on Substack Notes at ~6 AM NYT — these updates won’t be emailed.

Good evening,

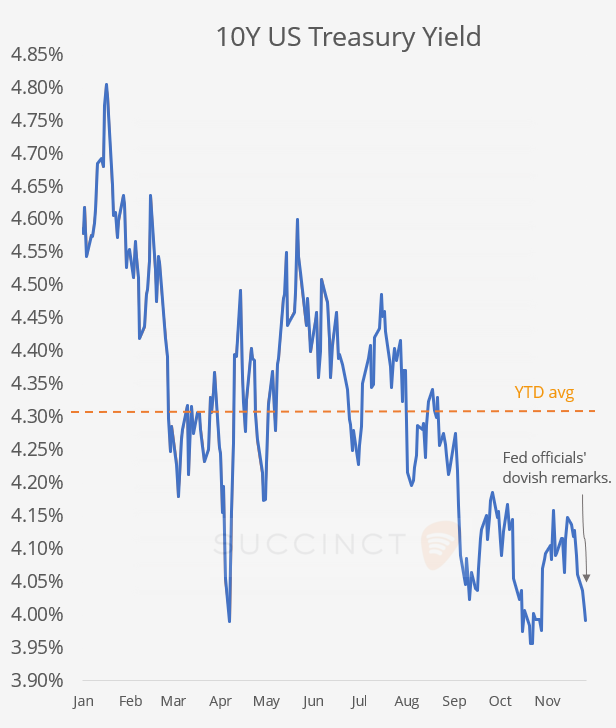

Wall Street extended its pre-Thanksgiving rally, with the Dow, S&P 500, and Nasdaq all advancing, supported by ongoing optimism for a Fed rate cut in two weeks. The chances for a 25bp rate cut on December 10 rose to 85% today from 30% a week ago.

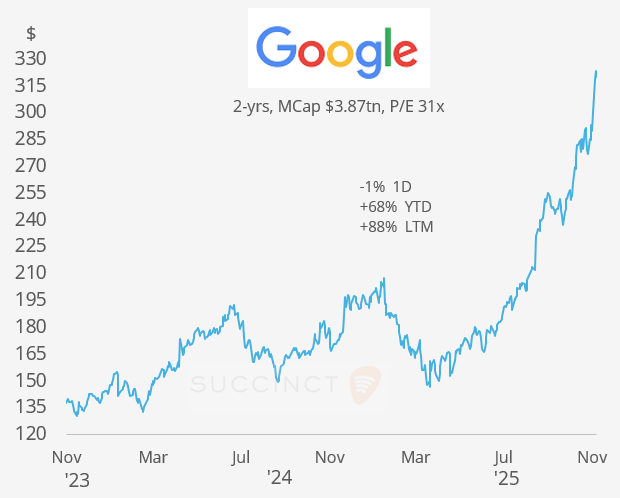

Alphabet hit a fresh record high yesterday amid signs it could challenge Nvidia’s AI chip dominance. Today, every US equity sector rose except for a modest decline in healthcare.

The VIX index plunged to a four-week low near 17%, down sharply from 28% just five sessions ago.

In forex markets, £ gained 0.5% on Budget Day, and the Aussie dollar rose 0.8% after higher inflation data.

Bond yields edged lower, with the 10-yr Treasury falling below 4% for the first time in a month, and the curve down ~13bps over the past week. Precious metals surged, with Silver up 5% near record highs and Gold firm at $4,163. Crude oil remained range-bound despite a surprise EIA inventory build of 2.8mn barrels, well above estimates for a draw.

Earnings: → Despite a Q4 beat (revenue +11% YoY; net income $1bn, EPS $3.93, -14% YoY), Deere & Co’s (mcap $128bn) shares tumbled 5.6% after it issued a weak fiscal-2026 profit outlook — blaming tariffs, margin pressure and a down-cycle in large-ag equipment demand. Shares remain 12% higher this year.

Central Banks: → The Fed’s Beige Book indicated that activity is mostly steady, price pressures are moderate, and employment/consumer trends are only slightly softer in some districts. Nothing significant to shift Fed expectations immediately.

Economics: → US Initial Jobless Claims fell to 216k for the week ending Nov 22, marking the lowest reading in seven months and well below forecasts of ~225k. The drop, despite recent layoff announcements, suggests layoffs remain subdued, underlining continued resilience in the US labour market.

→ The latest report showed US new orders for durable goods rose 0.5% in September, in line with expectations and building on a strong 3.0% increase in August.

→ Australia’s headline inflation rose 3.8% YoY in October — above the 3.6% expected and the highest rate since mid-2024. The Aussie dollar jumped about 0.8% on the news.

Deals: → In private markets, Blackstone is nearing a roughly $4bn acquisition of MacLean Power Systems from Centerbridge Partners, a deal that would fold the US utility-parts manufacturer into Blackstone’s growing infrastructure portfolio. Based in South Carolina, MacLean Power supplies essential equipment for electric-power transmission and distribution (anchors, grounding hardware, insulators, connectors, and other grid components).

UK Budget Takeaway: Taxes rise by £26bn, hitting high earners and property owners, while public spending gets a boost for the NHS (Healthcare), schools, infrastructure, and energy support.

Crypto Space: → S&P Ratings downgraded Tether’s stability rating to “5 (weak)” on concerns over its reserves to back the USDT stablecoin. — the lowest possible score under its stablecoin-assessment framework. S&P cited a growing share of “higher-risk assets” (including Bitcoin, corporate bonds, secured loans, and gold) backing USDT, along with “persistent gaps in disclosure” around counterparty and custodian risk. USDT’s market cap stands at an all-time high of $184bn.

Week Ahead:

Data → Th: Canada GDP; Germany, Italy and France inflation. M: US ISM Mfg PMI. T: €-zone inflation. F: US PCE inflation, personal income and spending, Michigan Consumer Confidence.

Earnings → T: Crowstrike Holdings. W: Salesforce, Inditex, RBC, NBC. Th: TD Bank, CIBC, Bank of Montreal, HPE.

A reminder that US markets will be closed on Thursday and will have an early close on Friday. Happy Thanksgiving 🦃

See you next week.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.