Wed 29 Oct: After the Bell

Your 5’ evening market wrap 📄🎙️📈

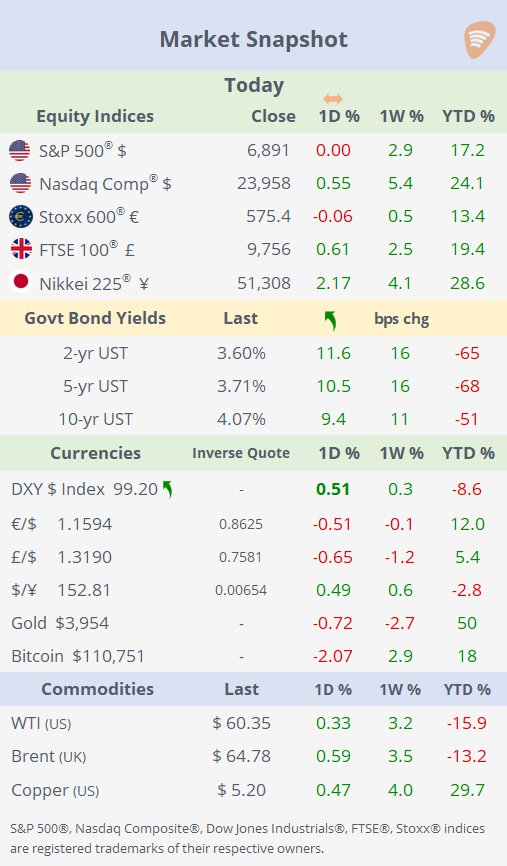

See the ‘Market Data’ post for tables & charts.

Good evening,

Risk assets traded relatively firm through most of the session until Powell’s press conference triggered a sharp reversal. While the Fed cut rates as widely expected, Chair Powell’s hawkish tone regarding the December meeting caught traders off guard, sending bond yields sharply higher. The Treasury curve shifted upward by roughly 10bp, with the short end accumulating a 16bp sell-off over the past week. The DXY dollar index strengthened to a two-week high, and equities turned lower into the close, though Nasdaq stocks managed to finish slightly firmer, while mid- and small-cap benchmarks lagged. After the bell, three mega-cap companies reported mixed earnings results, adding to the volatility backdrop.

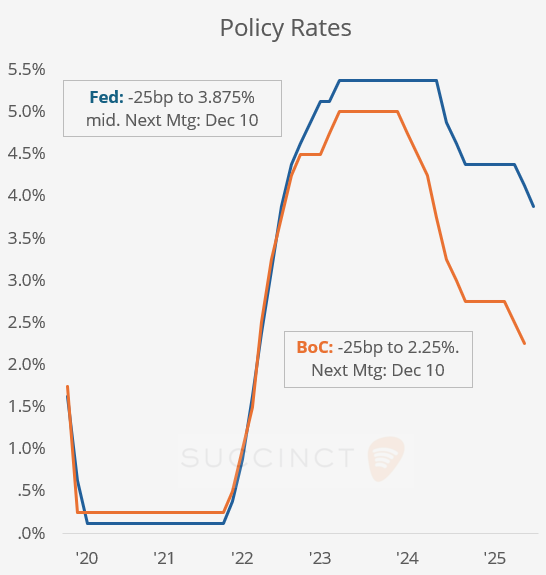

Monetary Policy: → The Fed cut its benchmark interest rate by 25bp to a range of 3.75% to 4% as widely anticipated, marking its second consecutive reduction this year and a drop from a high of around 5.375% fourteen months ago. Despite easing, Fed Chair Powell stressed that a December rate cut is not guaranteed, reflecting a mildly hawkish tone amidst economic uncertainty caused by a data blackout. The Fed also announced it would end quantitative tightening from December. The decision passed with a 10-2 vote, with dissents favouring either no change (Schmid) or a larger half-point cut (Miran). Futures markets now price a 34% chance of no rate change in December, up from 9% yesterday.

“I don’t see significant deterioration anywhere in the economy” “Rate cut in December is ‘far from’ a foregone conclusion”, Powell said.

→ The Bank of Canada also cut its key interest rate by 25bp to 2.25%, marking the second consecutive cut since March and the lowest since mid-2022, to support the economy amid ongoing weakness caused by the US trade war. The bank signalled that this may be the end of its easing cycle if inflation and economic growth follow current forecasts, while cautioning that monetary policy cannot undo the structural economic damage caused by trade tensions.

Earnings: Most of today’s action unfolded after the close, with three mega-cap tech names posting mixed results that drove sharp moves in extended trading. Meta beat revenue estimates but reported a one-time $16bn tax charge, sending its shares down 9%. Microsoft and Alphabet both exceeded top- and bottom-line expectations; however, Microsoft slipped 2% after hours, while Alphabet surged as much as 6%. During the regular session, Boeing fell 4% following a wider-than-expected quarterly loss tied to a $5bn charge on its 777X wide-body jet program.

Economics: → US pending home sales were unchanged in September, following an upwardly revised 4.2% increase in August, but fell 0.9% YoY, reflecting softness likely due to labour market concerns despite lower mortgage rates.

→ Australia’s annual inflation rate rose to 3.2% in Q3, up from 2.1% in Q2, marking its highest level since mid-2024, above forecasts and over the RBA’s target band of 2-3%.

Deals: → Healthcare giant Thermo Fisher Scientific (mcap $214bn) announced the acquisition of privately held endpoint data solutions provider Clario Holdings for $8.9bn. The deal aims to boost Thermo Fisher’s clinical research, digital, and AI capabilities. Sellers include Astorg, Nordic Capital, Novo Holding, and Cinven.

→ Minneapolis-based Jamf Holding (mcap $1.7bn), specialising in managing and securing Apple devices in enterprise, education, and government environments, has agreed to be acquired by Francisco Partners in a deal valued at approximately $2.2bn. Shares jumped 15%.

→ Japan’s NEC Corp (mcap $44bn) agreed to acquire US telecom and broadband software provider CSG Systems International (mcap $2.2bn) for $2.9bn in cash, a 17% premium to the prior close. CSG shares gained 14% to an all-time high and accumulated a 53% return this year.

Day ahead:

→ Monetary Policy: ECB (unch at 2% exp) and BoJ (unch at 0.5% exp)

→ Data: US, Germany, France, Italy GDP updates; Germany and Spain inflation; €-zone unemployment rate.

→ Earnings: AM: Eli Lilly, Mastercard, Merck. PM: Apple, Amazon. EU: Shell, TotalEnergies, BBVA.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.