Wed 3 Dec: After the Bell

Soft Jobs Data Fuels Rate-Cut Optimism. Your 5’ evening market wrap📄📈

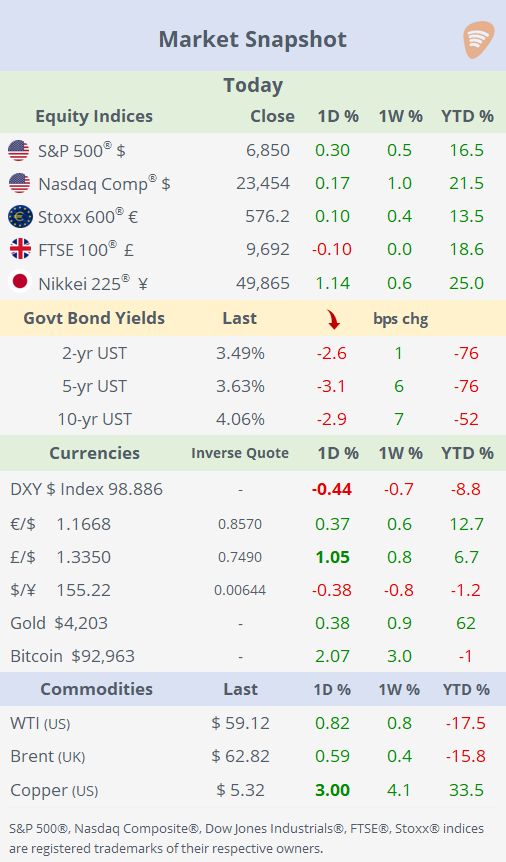

ℹ️ Today’s performance tables & charts on the ‘Market Data’ post.

ℹ️ We started posting a ‘Morning Markets Update’ on Substack Notes at ~6 AM NYT — these updates won’t be emailed.

Good evening,

Wall Street equities closed higher on Wednesday as a sharp deterioration in ADP employment data prompted investors to increase their conviction that the Fed will cut rates next week, with futures now pricing an 89% probability of a move. With attention squarely on the labour market, markets are betting that a lower-rate environment could revive loan growth and provide a boost to the broader US economy.

Equity benchmarks finished modestly higher, led by gains in energy and financials, while European markets were little changed. Core bond yields drifted a few basis points lower, with the 10-year Treasury remaining firmly range-bound between 4.0% and 4.15% in recent months.

In FX markets, £ rallied 1% to a one-month high after UK business activity surprised to the upside, prompting traders to unwind bearish positions. A stronger-than-expected Composite PMI reading (51.2 vs. 50.5 forecast) reinforced improving economic sentiment and coincided with a softer dollar. The DXY $ index fell to a one-month low as the $ weakened against all other majors today. Bitcoin maintained its recovery, advancing 2% to over $93k, a two-week high.

Business News: → OpenAI triggered a “code red” as Sam Altman moved to re-prioritise speed, reliability, and personalisation in ChatGPT amid intensifying competitive pressure. The shift comes as French start-up Mistral launched a new suite of high-performance open models, underscoring the rapid advances by challengers. Together, the developments highlight an accelerating race for leadership in next-generation AI systems.

Data: → The ADP report showed US private-sector employment sank by 32k jobs in November, a sharp reversal from the prior month and well below the ~10k job gain analysts expected. The weak print — the biggest drop since spring ‘23 — reflects softness particularly among small businesses and has reinforced market expectations of a rate cut by the Fed next week.

→ Switzerland’s annual inflation rate dropped to 0.0% in November 2025, the lowest since May. The unexpectedly soft reading underscores subdued price pressures and reduces near-term urgency for additional tightening by the Swiss National Bank. The CHF appreciated nearly 0.5% today to 0.800 against the $.

Earnings: → After the close, Salesforce (mcap $228bn) posted Q3 FY26 revenue of $10.3bn, +9.5% YoY, broadly in line with expectations. Net income surged 40% YoY to $2.1bn, with diluted EPS rising 39% to $2.19, showing strong operating leverage. Overall, the quarter delivered solid top-line growth and very strong profitability, supporting management’s upbeat outlook. Shares gained 5% in extended trading beyond the 1.7% they gained during the session, but remain 28% lower this year.

→ Zara-owner Inditex (mcap €166bn) delivered a strong Q3 2025 result — net income rose 9% and sales accelerated, while early-Q4 sales grew 10%. Investors cheered the beat, sending shares up around 9%, as the performance underlines resilience despite a challenging consumer backdrop and positions Inditex well heading into the holiday season.

Deals: → Smiths Group Plc (mcap £8bn) agreed to sell its security-scanning subsidiary, Smiths Detection, to CVC Capital Partners for $2.6bn. The company will return roughly £1.85bn of net proceeds to shareholders. The divestment continues Smiths’ strategic shift toward a more focused core engineering portfolio. Smith’s shares are 43% higher this year, at an all-time high and trade at 30 times trailing P/E.

→ Marvell Technology (mcap $86bn) agreed to acquire photonics-focused chip startup Celestial AI for $3.25bn in a cash-and-stock transaction, aiming to strengthen its position in next-generation optical interconnects for AI workloads. The deal gives Marvell access to Celestial’s light-based chip-to-memory technology, enhancing its competitiveness against Broadcom and Nvidia, and reflects management’s bullish outlook for growth next year. Marvell shares rose 7% today but remain 10% lower YTD.

→ In private markets, Verkada, the US security technology firm specialising in cloud-based workplace safety and surveillance systems, secured a new funding round led by CapitalG that values the company at $5.8bn; $1.3bn higher than its valuation in February. The raise reflects continued strong demand for integrated physical-security and access-control solutions.

Day Ahead:

Data → US balance of trade, weekly initial jobless claims; €zone retail sales; Brazil GDP.

Earnings → TD Bank, Bank of Montreal, CIBC, Kroger, Hewlett.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.