Wed 3 Sep: After the Bell

🎙️📄+ Market Data

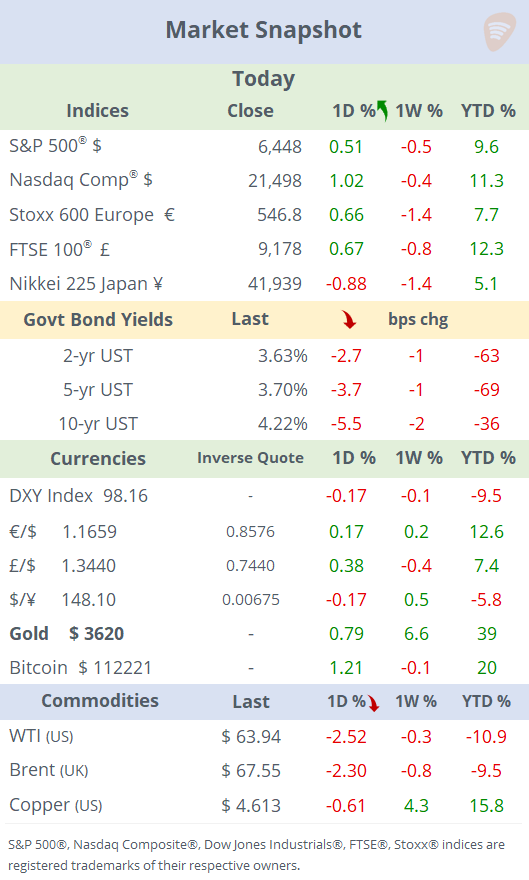

See the ‘Market Data’ post.

Good evening,

Tuesday’s risk-off sentiment proved short-lived, as equities and bonds rebounded today, led by a tech rally driven primarily by Alphabet’s 9% jump. A weaker-than-expected U.S. job openings report boosted bonds, pushing yields lower across the curve. The disappointing employment update ahead of Friday’s non-farm payroll release, along with corporate layoff headlines, lifted bond prices, driving 10-year Treasury yields down to close at 4.22%.

Crude oil prices fell over 2% today on concerns that OPEC+ may raise production targets at its upcoming meeting on Sunday, adding to potential oversupply. The eight OPEC+ producers that have been unwinding production cuts for several months will discuss another increase in production. Brent was trading at $67.5 at the NY close. (Reuters)

On the geopolitical front, leaders from China, Russia, and North Korea showcased unity at a high-tech military parade and economic summit in China, deepening existing alliances. (BBC)

Earnings: Discount retailer Dollar Tree (mcap $21bn) beat revenue ($4.6bn), significantly exceeded profit estimates ($164mn) and also raised full-year guidance but warned on the tariffs' impact on margins, leading to a steep 8% stock sell-off. It remains 35% higher YTD and trades at a trailing P/E of 20x.

After today’s close, Salesforce (mcap $245bn) and Hewlett-Packard Enterprises (mcap $30bn) reported results that beat estimates. However, weak sales guidance from Salesforce sent shares down 4% in extended trading, while a cautious outlook by HPE pulled shares lower by ~3%. Chip giant Broadcom reports tomorrow after the close. As the Q2 earnings season nears completion, EPS at S&P 500 companies rose ~13% YoY.

Economics: U.S. JOLTS job openings fell to 7.18mn in July, missing expectations, the weakest in one year and signalling an unexpected cooling in labour demand. U.S. factory orders declined by 1.3% MoM in July, in line with forecasts and showing improvement after June’s steep drop. The MBA 30-year mortgage rate is 6.64%, the lowest since April.

Central Banks:

The Fed Beige Book takeaway: Most districts reported ‘little or no change’ in economic activity; consumer spending was flat or declining in many regions; some districts saw modest declines in labour demand, and price increases remained moderate. Overall, the report points to slightly weak economic conditions. The implied probability from futures for a quarter-point rate cut by the Fed in two weeks rose to 95.5% from 93% yesterday.

Bank of England Governor Bailey said markets had grasped his signal that interest rates will keep trending down gradually, though he cautioned there is now greater uncertainty over how quickly the cuts will unfold.

"There is now considerably more doubt about exactly when and how quickly we can make those further steps," Governor Bailey said.

In notable business stories, oil & gas giant ConocoPhillips (mcap $118bn) announced plans to cut 20–25% of its global workforce (~3,000 jobs) by the end of next year as part of a restructuring triggered by lower crude prices. Shares fell >4% today and are 14% lower in the LTM. (Reuters)

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.