Wed 5 Nov: After the Bell

Your 5’ evening market wrap 📄📈

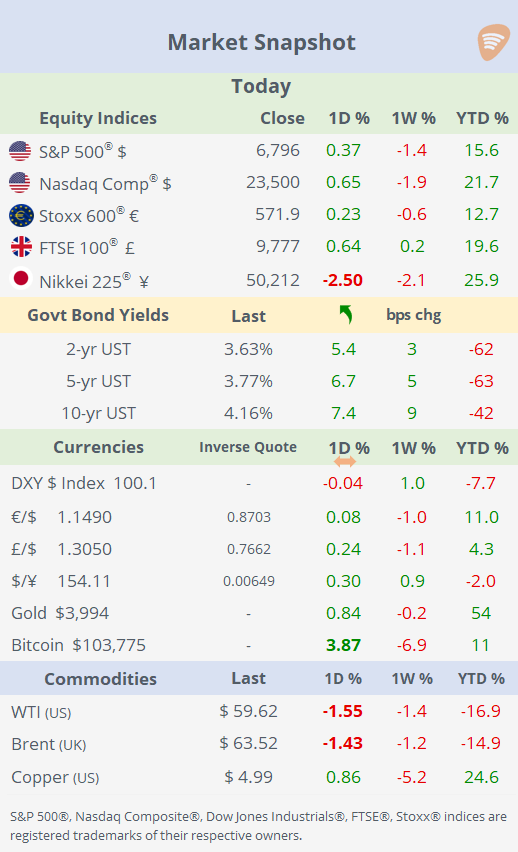

See the ‘Market Data’ post for tables & charts.

Good evening,

US stocks rebounded after yesterday’s weakness, supported by a stronger-than-expected ADP employment report, a resilient Services PMI, and developments from the Supreme Court on tariffs. Leading indices rose 0.5% on average, with Consumer Discretionary leading the gains and the Russell 2000 outperforming with a 1.5% advance; all sectors finished either firmer or flat. Core bond yields climbed, with the 10-yr Treasury hitting its highest level in a month, while WTI oil fell 1.5% following a larger-than-expected EIA crude stock build (+5.2mn barrels).

Qualcomm (mcap $194bn) beat earnings estimates after the close on strong chip demand, but shares slipped slightly (-2%) in after-hours trading as guidance failed to fully reassure investors.

Today´s notable stock mover was mid-cap Pinterest (mcap $17.5bn) as shares plunged 22%, their second-worst day ever, after reporting Q3 revenue of $1.05bn, above estimates but missing on profits. The company also issued soft Q4 revenue guidance, citing advertising headwinds in North America and tariff-driven margin pressures, fuelling investor concerns about growth and competition. The stock is down 11% YTD.

Geopolitics: During a hearing today, the US Supreme Court expressed significant scepticism about Trump’s authority under the International Emergency Economic Powers Act to impose sweeping global tariffs without explicit congressional approval.

Data: → US ADP private‑sector employment increased by 42k jobs in October, above the consensus estimate of 30k and a reversal from the -32k a month ago. This report serves as a proxy for private‑sector job growth in October, as the official nonfarm payrolls data remains delayed due to the government shutdown.

→ The US Services PMI (by S&P) came in at 54.8 in October, showing continued expansion in the sector and signalling that service activity remains resilient despite broader economic uncertainties.

→ Eurozone PPI inflation fell 0.2% YoY in September, in line with expectations, signalling a deceleration in declining wholesale prices.

Central Banks: Fed Governor Stephen Miran said that a December rate cut would be “a reasonable action,” signalling openness to further easing. His comments follow Chicago Fed Goolsbee, Fed Governor Lisa Cook, and San Francisco Fed Daly, who remain undecided on whether to reduce rates at the year-end meeting.

No major corporate deals were announced today, with M&A activity remaining quiet mid-week.

IPOs: Tampa, Florida-based insurtech Exzeo Group, which provides software and analytics solutions to property & casualty insurers, raised $168mn in its NYSE IPO, pricing at $21 and valuing the company at $1.9bn. Stock ended flat today.

Day ahead:

→ Bank of England´s policy meeting (unch at 4% exp).

→ Data: Eurozone retail sales, US jobless claims.

→ Earnings: ConocoP, Airbnb, AstraZeneca.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.