Wed 9 Jul: After the Bell

🎙️📄

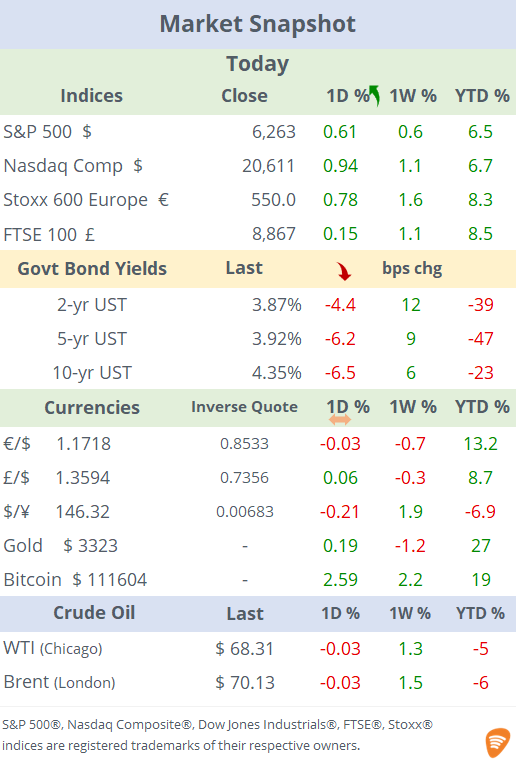

See the ‘Market Data’ post.

Evening,

Equity markets finished on a positive note on both sides of the Atlantic on Wednesday with the Nasdaq Composite and the Dax reaching record highs. Nvidia advanced 1.8% but had an intraday all-time high that valued the company above $4tn, a historic record. The VIX Volatility Index dropped below 16% for the first time since February. Bond yields extended their declines after a 10-yr Treasury auction ($39bn) received strong demand. The day’s performance catalysts included the FOMC minutes, new tariff headlines from Trump and deflation in China.

Today's trade war updates focused on more so-called reciprocal tariffs that countries will face if they don't make deals as Trump sent more letters to Asian and Middle Eastern nations while anticipating 50% levies on Brazil. The European Union is targeting a framework trade deal with the US this month—and possibly within days—a spokesperson said. The stock market strength shows investors are looking past the tariff turmoil, betting that the White House will ultimately hold back from enforcing its most severe threats.

In central bank action, the Reserve Bank of New Zealand kept its policy rate (OCR) on hold at 3.25% for the first time in a year as expected but signalled further easing in the near term.

Fed’s FOMC Minutes of last month’s meeting takeaway: mostly hawkish with only two policymakers (Waller and Bowman) backed a cut as soon as July, while the rest favored waiting for clearer data. Rising US tariffs have clouded the outlook; if the inflation impact proves temporary, cuts are more likely but if persistent, the Fed may hold rates longer. Median forecasts still point to two 25 bp cuts in 2025. The FedWatch shows a 93% probability of the funds target rate to remain steady (4.375% mid) at the Fed’s meeting in three weeks.

The main economic data today came out of China with yearly inflation rising by a mere 0.1% after four months of declines but producer inflation (PPI) fell sharply, -3.6% YoY, the steepest deflation in two years and much worse than estimates. The main driver is export-oriented manufacturers that are struggling amid uncertainty from trade tariffs, prompting them to slash prices.

Commodities: today’s notable mover was Natural Gas with a 4% drop to a six-week low after the EIA reported a higher-than-expected increase in inventories. (a 96 Bcf injection for the week ending June 20, surpassing the 88 Bcf consensus). This brought inventories to 6.6% above the five-year average, indicating a comfortable supply situation.

Corporate deals: in US pharma, Merck & Co (mcap $210bn) is acquiring lung disease-specialist biotech Verona Pharma (mcap $9bn, London-based) in a $10bn deal. Verona shares jumped 20% to an all-time high and accumulated a 123% gain this year. The transaction marks Merck’s largest acquisition since its $11bn takeover of immunology-focused Prometheus Bioscience in 2023.

In the European banking sector, Italy’s UniCredit (mcap €94bn) doubled its equity stake in Germany’s Commerzbank (mcap €34bn) to 20%. Unicredit shares gained 4.6% while Commerz’s ended little changed.

IPOs: Spain’s Cirsa, a gambling co with 450 casinos in 11 countries that is backed by Blackstone since 2018, raised €400mn after selling 18% of its shares in Spanish exchanges with a positive debut that saw shares gain ~7% above its IPO price of €15 for a market valuation of €2.5bn.

In private markets, ChatGPT’s parent OpenAI has completed its acquisition of Jony Ive's AI startup io Products, valuing it at $6.5bn.

Credit ratings: Moody’s reaffirmed Israel’s ‘Baa1’ rating but cautions that the Iran conflict may worsen fiscal pressures.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.