Tue 21 Oct: After the Bell

🎙️📄+ Market Data

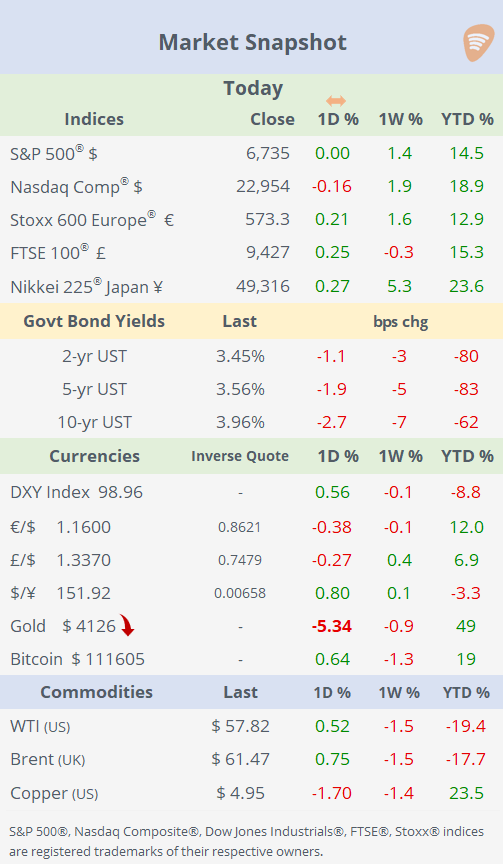

See the ‘Market Data’ post for tables & charts ➡️

Good evening,

Tuesday’s action was centred on the gold market, as the precious metal suffered its steepest daily decline in a decade, down over 5% from its all-time high. Easing trade tensions and a stronger dollar, particularly against a weakening Japanese yen, triggered a sharp reversal in gold prices as investors took profits. The whole precious metals complex plunged with Silver, Platinum and Palladium losing 7%. Stock indices, core bonds, and crude oil were little changed, with few notable events beyond a series of corporate earnings releases.

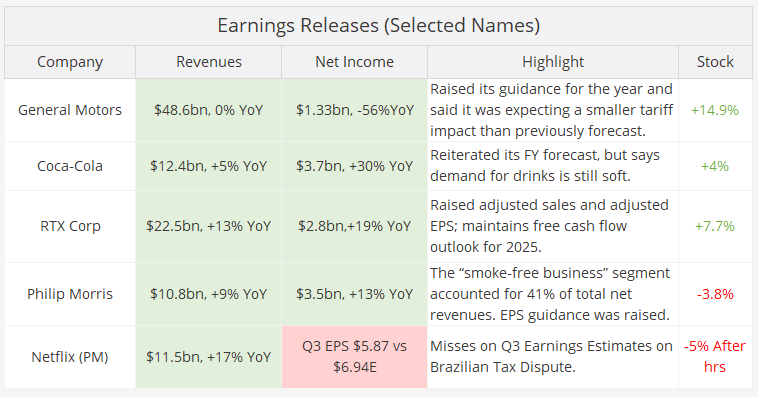

Earnings: Reports released before the market open from blue chips General Motors, Coca-Cola, and RTX Corp beat both top and bottom line estimates, setting a positive tone for the day. However, after the close, Netflix missed earnings expectations, and its shares fell 5% in extended trading. GM was the notable mover with a 15% gain as management highlighted profitability improvements despite EV challenges and easing tariff costs, boosting investor confidence and pushing the stock to record highs. This rally marks GM’s best single-day performance in over five years, amidst growing optimism over its operational discipline and future outlook.

Geopolitics: European and Ukrainian leaders today unveiled a 12-point peace proposal to end the war, backing Trump’s call to cease hostilities along the current front lines. However, a planned Trump-Putin summit in Budapest was cancelled after Russia rejected the immediate ceasefire demand, reflecting stalled diplomatic efforts despite ongoing international pressure.

Central Banks: Bank of England Governor Bailey warned of “alarm bells” ringing over the private credit market, drawing parallels to risky practices before the 2008 GFC. Citing collapses of two US firms (First Brands and Tricolor) reliant on private financing, Bailey emphasised the need for caution as the BoE plans stress tests to assess potential systemic risks in this opaque and leveraged sector.

Economics: It was a light day on the data front. Canada’s headline inflation accelerated to 2.4% YoY in September, the highest reading since February. Core inflation rose by 2.8%, the fastest pace in two years. These figures suggest that the Bank of Canada may exercise caution in pursuing further rate cuts from the current 2.50%, given that inflation remains persistently above target ahead of its meeting next Wednesday.

Corporate Deals: Blackstone and TPG have agreed to acquire Hologic (mcap $16.5bn), a women’s health company, in a transaction valued at up to $18.3bn including debt. Terms: $76 per share in cash, representing a roughly 46% premium to Hologic’s undisturbed price, plus a contingent value right of up to $3 per share based on future revenue milestones. Shares gained 3% today but remain little changed this year.

CenterPoint Energy (mcap $26bn) is selling its Ohio natural gas local distribution business, Vectren Energy Delivery of Ohio, to National Fuel Gas (mcap $7.5bn) for $2.62bn. The sale supports CenterPoint’s capital plan to optimise its portfolio, while National Fuel expects the acquisition to double its gas utility rate base and immediately boost earnings.

Warner Bros. Discovery (mcap $50bn), owner of CNN, HBO and TNT among other leading media outlets, is exploring a potential sale of all or part of its media assets after receiving unsolicited interest from multiple parties. While the company had planned to split into two entities by mid-2026, it is now broadening its strategic review to consider alternative options that maximise shareholder value. Shares gained 11% today and accumulated a 92% return YTD.

Day Ahead:

Data: UK inflation, Indonesia policy rate, and Japan trade.

Earnings: Tesla, IBM, AT&T, Thermo F, CME, Moody’s, Hermes, SAP, and Barclays.

See you tomorrow. Please 🙏 use your referral link to share!

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.